When Will New Car Prices Drop Again?

New car prices have been rising in recent years, leaving many prospective buyers reeling from sticker shock. This trend has been driven by a confluence of factors including pandemic-related issues. As a result, it has become more difficult for most people to afford the vehicle they need and want.

While the current market conditions seem uncertain, car buyers are still hoping for the trend to reverse. In the meantime, consumers are taking a variety of approaches. Some are turning to used cars, while others are exploring alternative transportation options or financing options. However, the demand for these other options also drives their prices.

Vehicle prices will always impact car owners, buyers, and sellers as they affect affordability, value, competition, sales, and financing options. As consumers change their buying behavior accordingly, dealers and other auto industry businesses rely on market data for planning and executing business strategies.

Factors Driving the Increase in New Vehicle Prices

The prices of vehicles are affected by several factors: supply and demand, production costs, economic conditions, government policies and taxes, brand and model reputation, age, and mileage. Some industry insiders and analysts narrow down the list to some undeniable reasons.

Kelley Blue Book (owned by Cox Automotive) says the following can lead to price increases in the short term:

- Limited inventory due to supply chain issues (chip shortage) or production delays which lead to higher prices.

- Incentives from automakers and discounts from dealerships to encourage consumers to buy new vehicles. (As manufacturers and dealers make up for the discount they offer, there is a temporary increase in prices).

- Lower vehicle trade-in value, resulting in a higher price.

JP Morgan attributes the trend mainly to these conditions:

- Shortages in semiconductor supplies on a global scale resulted in a slowdown in automotive production.

- Increase in non-commodity costs (inflation-driven) which are passed on to car manufacturers.

New Car Prices Through the Years and the Covid-19 Pandemic

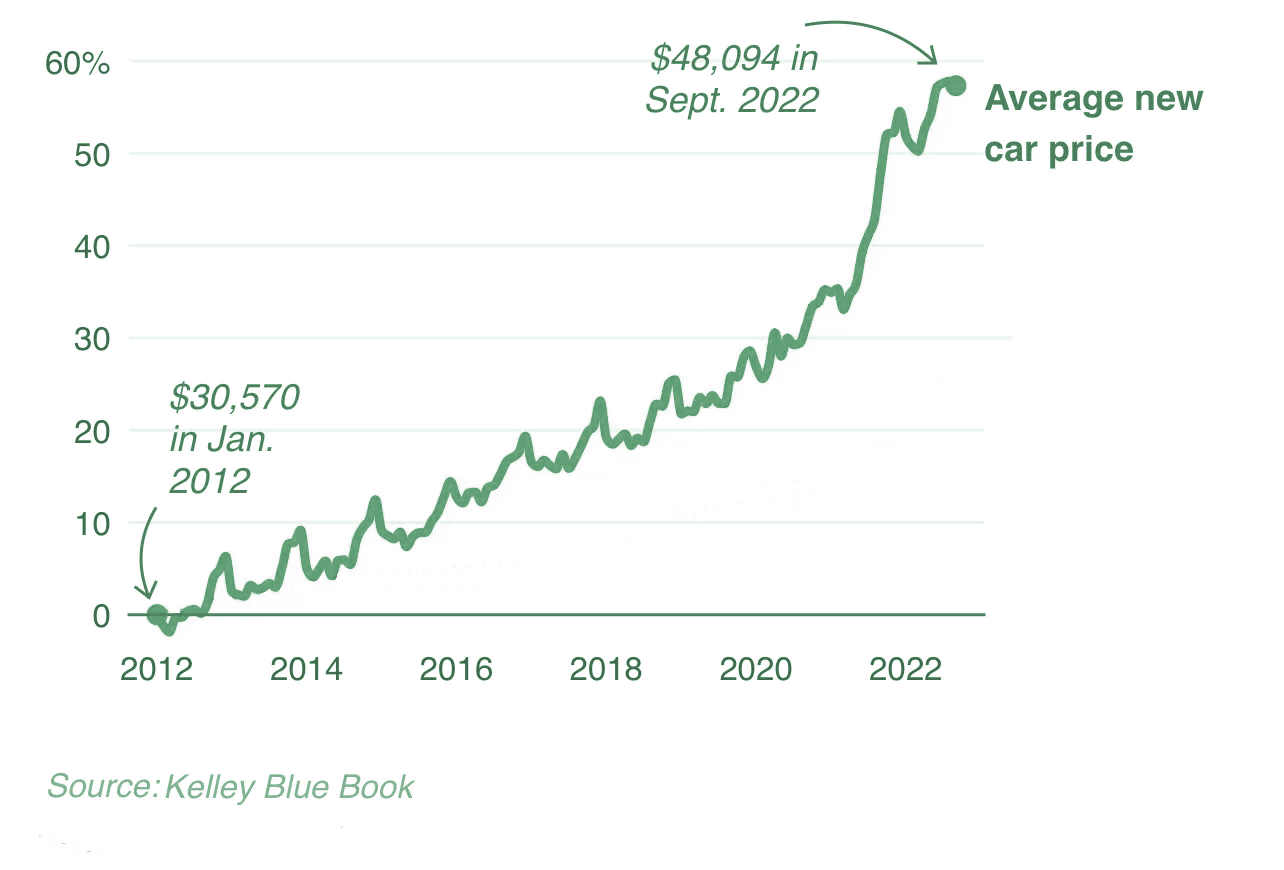

Looking at the timeline below, it is easy to see that the COVID-19 pandemic ushered in car price increases in the US that are nothing less than dramatic.

2010-2018: Less than 3% increase annually, remaining relatively stable throughout the decade.

2019: A modest increase of 5% compared to the previous year.

Early 2020: Stable for the first half of the year, with only minor fluctuations.

Mid to late 2020: Dramatic spike, 17.2% compared to the previous year due to the COVID-19 pandemic and global supply chain disruptions

2021: Increase by 11.8% in the average new transaction price.

2022: Record-high average new car price by December at $49,507, with an increase of 4.9% ($2,297) from year-earlier levels.

Why New Car Price Increase is Slowing Down

March 2023 marked a break in new car prices. For the first time after 20 months, buyers paid less than the sticker price or the Manufacturer’s Suggested Retail Price (MSRP). According to Kelley Blue Book, the average price dipped to $48,008. Compared to the average price in 2022, this marks an increase of 3.8%.

Here’s why the price hikes are easing:

Increase in supply: One of the primary reasons for the price hike is the shortage of key components like semiconductors. As more manufacturers of components like semiconductors increase their production, the supply of new automobiles will increase, which could help bring down prices.

Decrease in demand: As demand decreases due to changes in consumer behavior or preferences, prices may naturally decrease as well. Growing concerns about a worsening economy and higher interest rates are holding back buyers.

And here’s why car prices will not drop as fast as we want them to be or down to pre-pandemic figures:

Semiconductor supply has improved but automobile production is still reduced: Some suppliers and automakers expect chip production to normalize by the end of 2023, while others think it will continue in 2024. As a result, car production is still down by a few million units.

Increased production is focused on more expensive, more profitable models instead of the cheaper ones: The shift in sales favoring cars worth $60,000 has benefitted automakers, encouraging them to produce more of these models for bigger profits.

Choosing Between New and Used Cars in 2023

If soaring prices have turned you off from new cars, you may be wondering whether used cars are a better option. Since the start of the covid-19 pandemic, used cars had their biggest increase ever (up 45%) in the 12 months ending in June 2021, according to the Consumer Price Index. However, by December 2022, the prices of used cars dropped 8.8% in the past year. Why? Because of the decline in demand for new cars and increased inventory.

As more new cars enter the market in the upcoming months, there may be more drops in used car prices. However, the prices of late-model used cars may not decrease as much because there was a drop in automobile production over the past three years, which could result in a shortage of those models.

So what do these trends in new and used car prices mean for the buyer? Obviously, consumers can benefit from decreased prices. However, choosing a new versus used car will still depend on several factors, including cost, depreciation, history, features, financing options, maintenance, and personal preference. If you’re buying a used car, due diligence is always a must regardless of the price. VinAudit’s NMVTIS-approved vehicle history reports can help you make a smart choice out of a few good options.

Doing Business in the Automotive Industry in 2023

Vehicle data is crucial in the current automotive market conditions. It can provide insights into the supply and demand for certain models, help in pricing vehicles, and determine market trends. By analyzing data such as sales volumes, transaction prices, and inventory levels, dealers and other auto industry businesses can make informed business decisions. One-stop-shop VinAudit.com offers bulk access to its data for different purposes: a dealer program for vehicle history reports, a reseller program for vehicle data, and market data feeds for vehicle retail intelligence.

While it is difficult to predict with certainty when new car prices will drop significantly, it is important for consumers and sellers to stay informed about current market trends and be prepared to adapt to changing conditions. The recent decrease in new car prices after 20 months of continuous increases could lead to further declines in used car prices in the months ahead, which may present opportunities for buyers. Sellers may need to adjust their pricing and marketing strategies to remain competitive in a changing market. Ultimately, staying informed and adaptable will be key to navigating the current automotive market conditions.